Captive insurance solutions for business tax savings and risk management

Discover how captive insurance solutions for business tax savings and risk management can help business owners lower tax liabilities, protect assets, and create long-term wealth. Learn how Fortune 500 companies use captive insurance to retain profits and reduce risks.

Captive Insurance Solutions for Business Tax Savings & Risk Management

Captive insurance solutions for business tax savings and risk management allow business owners to take control of their risk while reducing tax liabilities and creating a tax-free wealth-building strategy.

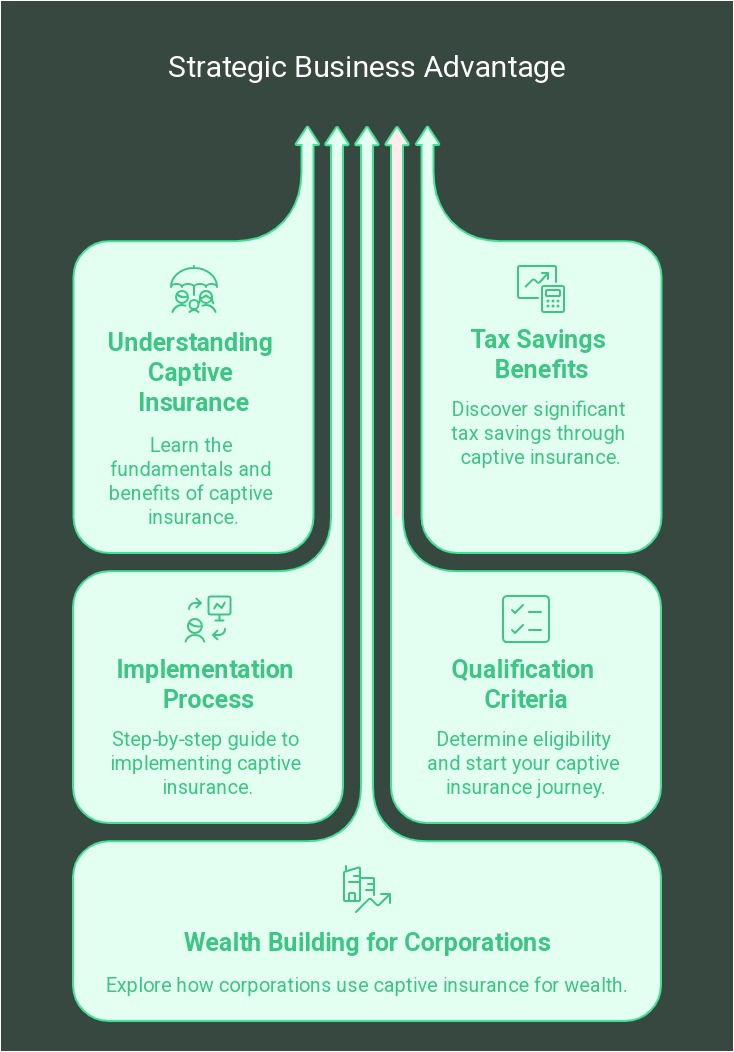

What is Captive Insurance & Why Do Smart Business Owners Use It?

The Biggest Tax Savings Benefits of Captive Insurance Solutions

How Captive Insurance Works: Step-by-Step Process

Who Qualifies for Captive Insurance & How to Get Started

How Fortune 500 Companies Use Captive Insurance to Build Wealth

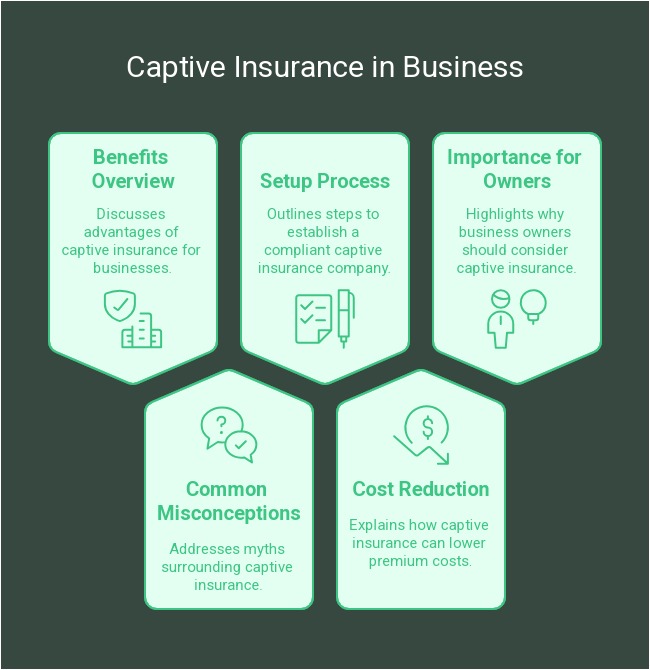

The Role of Captive Insurance in Business Tax Planning

Why Business Owners Should Consider a Captive Insurance Company

How Captive Insurance Helps Reduce Premium Costs & Retain Profits

Common Myths & Misconceptions About Captive Insurance

How to Set Up a Compliant Captive Insurance Company

What is Captive Insurance & Why Do Smart Business Owners Use It?

Did you know that Fortune 500 companies and large corporations operate their own private insurance companies to retain profits, reduce taxes, and self-insure against risk?

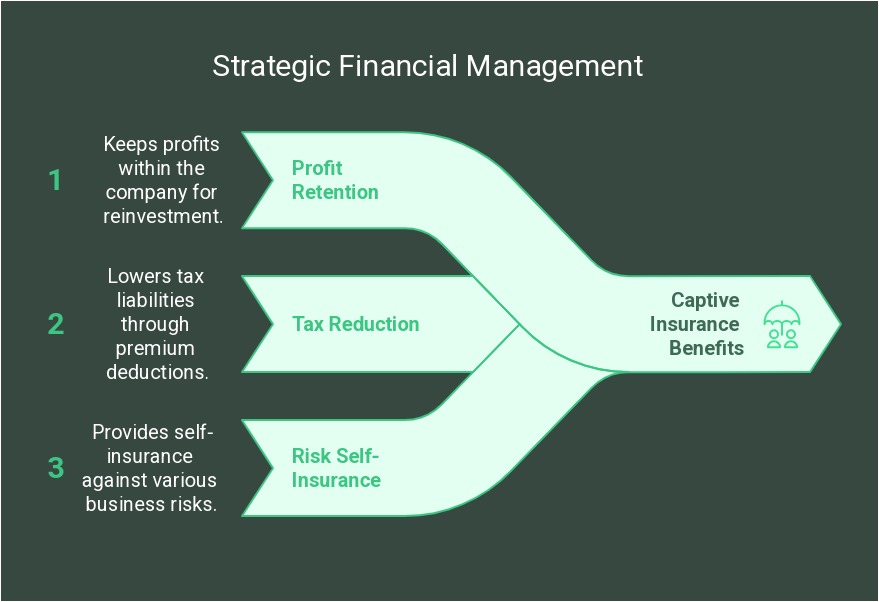

Captive insurance allows business owners to set up their own insurance company instead of relying on expensive third-party insurers. This strategy enables companies to:

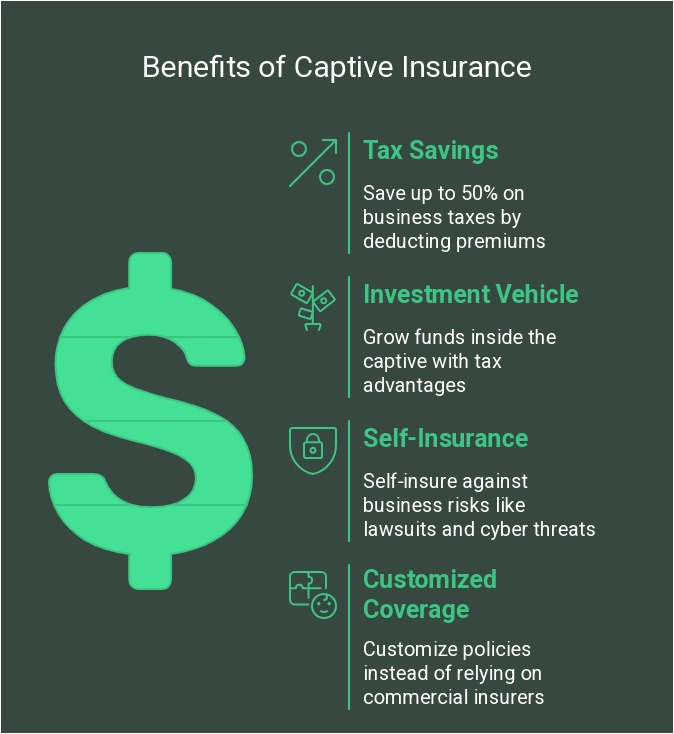

Save up to 50% on business taxes by deducting premiums paid into the captive as business expenses.

Create a tax-free investment vehicle by growing funds inside the captive with tax advantages.

Self-insure against business risks such as lawsuits, cyber threats, supply chain issues, and market volatility.

Gain greater control over coverage by customizing policies instead of relying on commercial insurers with high fees and broad coverage gaps.

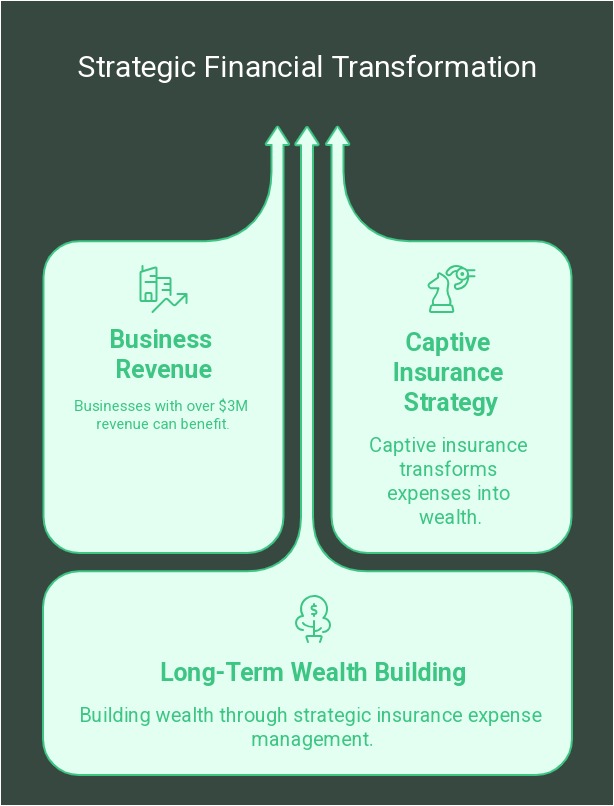

Captive insurance isn’t just for large corporations—businesses earning over $3M per year can leverage this strategy to transform insurance expenses into long-term wealth.

The Biggest Tax Savings Benefits of Captive Insurance Solutions

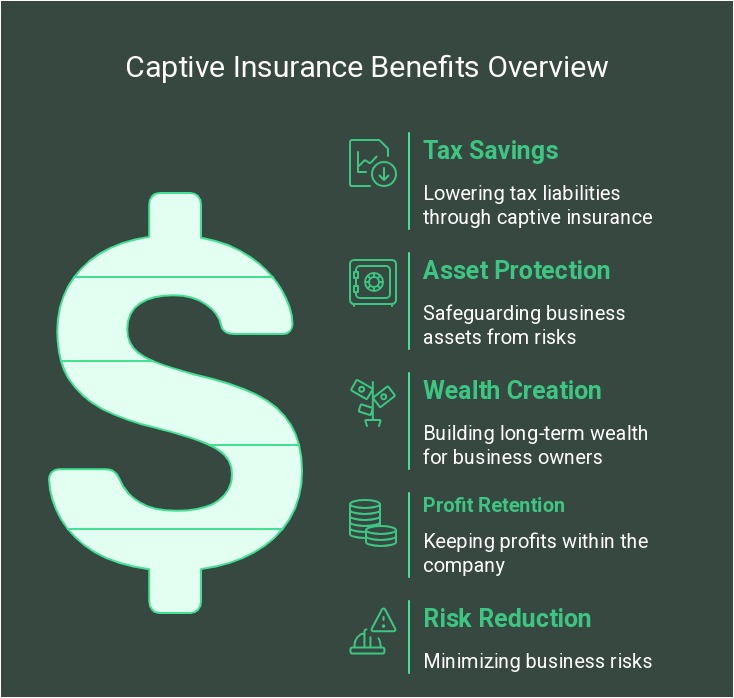

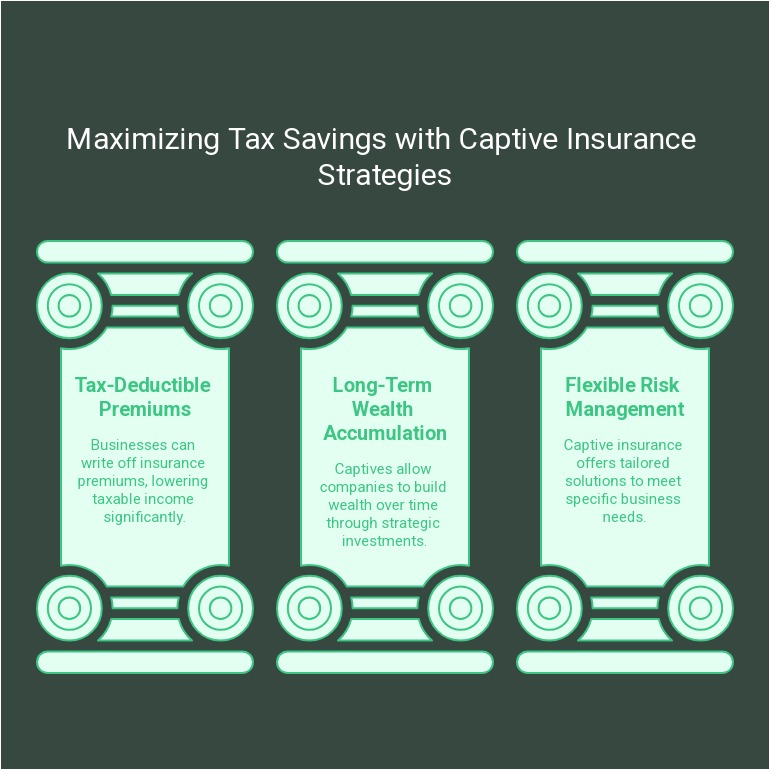

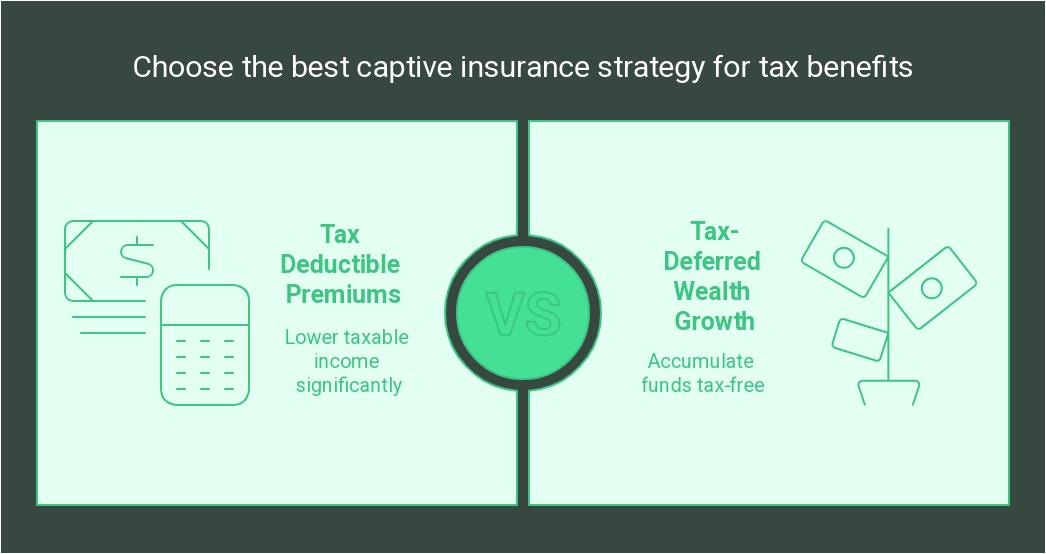

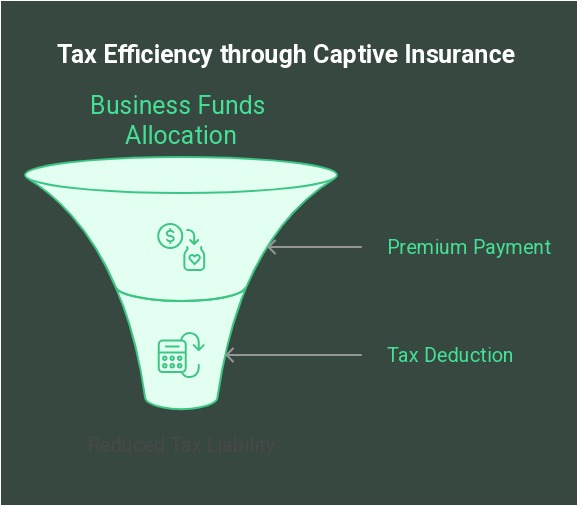

Tax Deductible Premiums

Businesses can write off insurance premiums paid into the captive, lowering taxable income significantly.

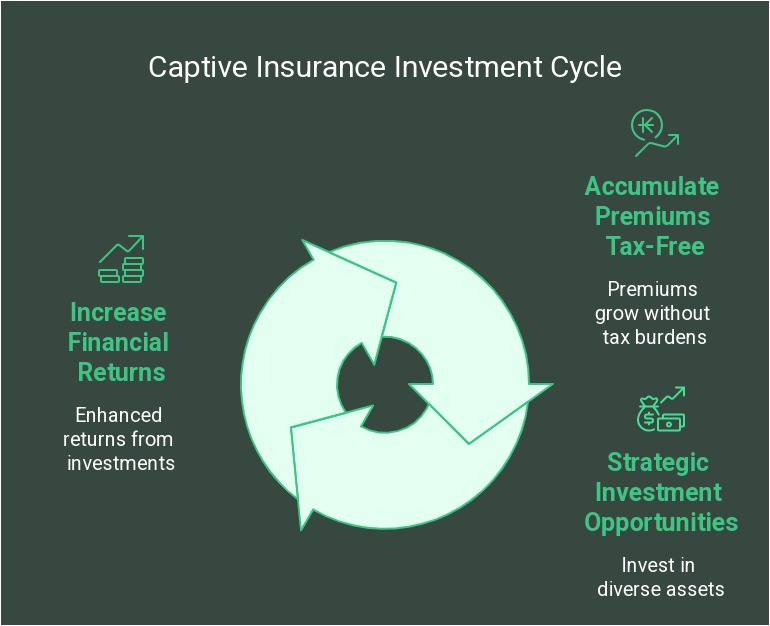

Tax-Deferred Wealth Growth

Unlike traditional insurance policies, the funds inside a captive insurance company accumulate tax-free, allowing for long-term financial growth.

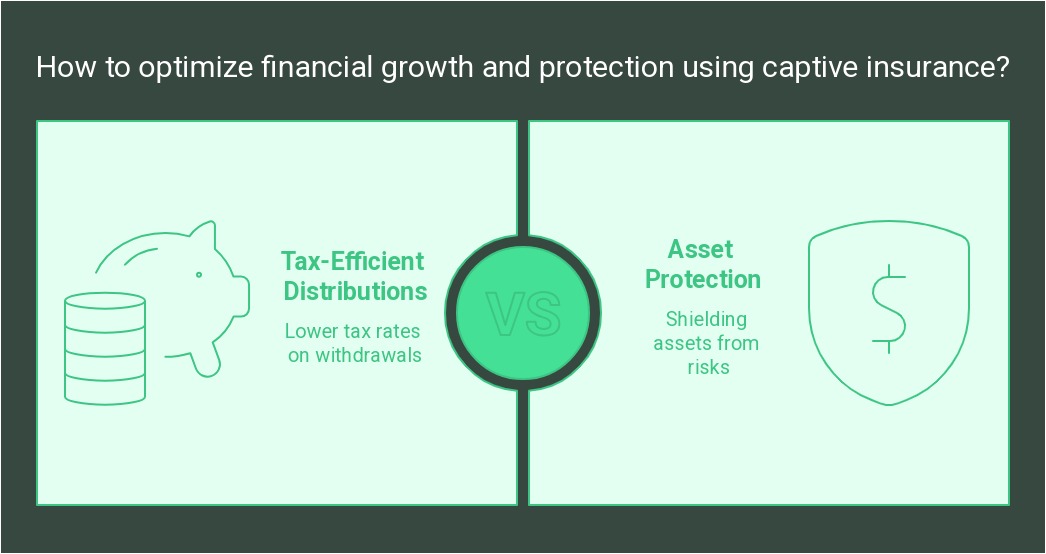

Tax-Efficient Distributions

When structured properly, owners can withdraw funds from the captive at lower tax rates, providing a powerful tax-efficient wealth accumulation tool.

Asset Protection

A captive insurance company shields business assets from lawsuits, creditors, and financial risks, ensuring stronger financial security.

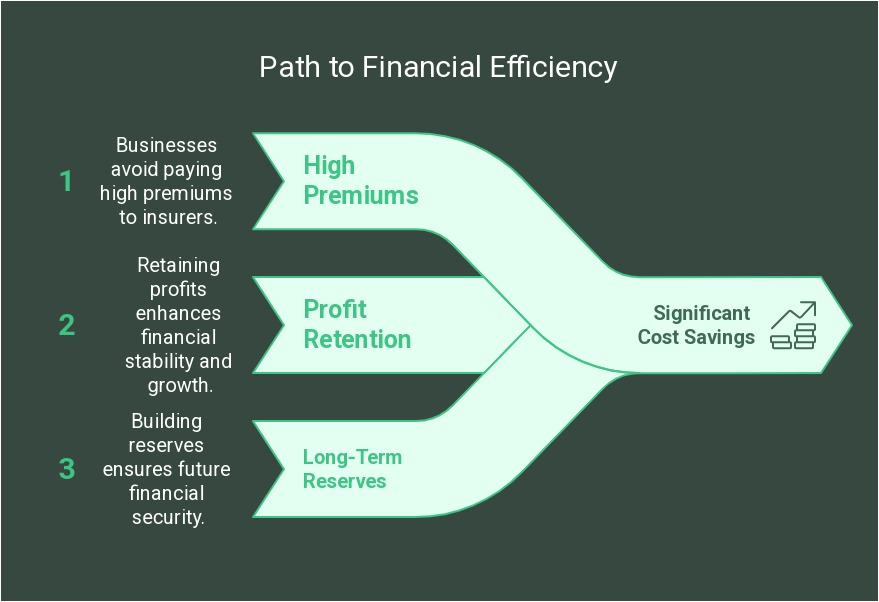

Significant Cost Savings

Instead of paying high premiums to third-party insurers, businesses retain profits and build long-term reserves.

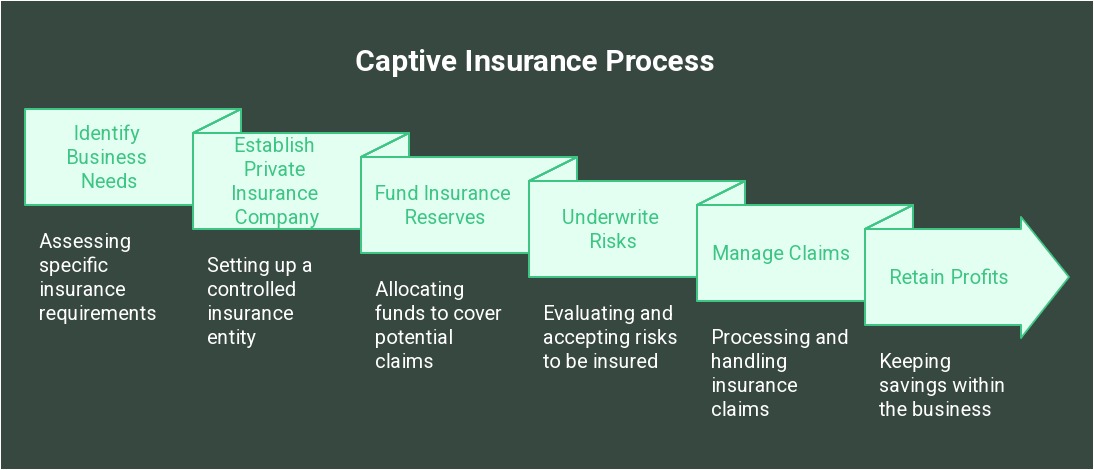

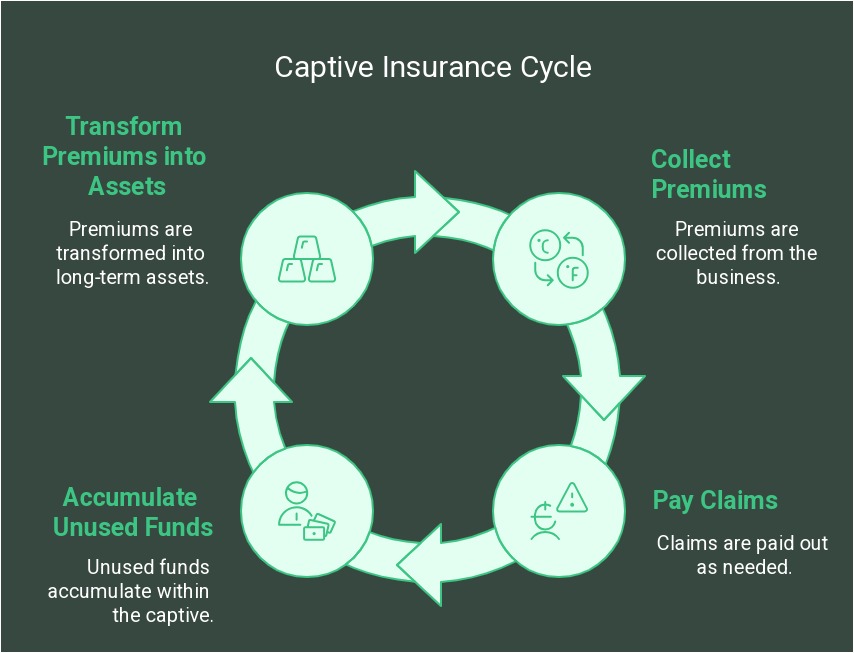

How Captive Insurance Works: Step-by-Step Process

Step 1: We Establish a Private Insurance Company Under Your Control

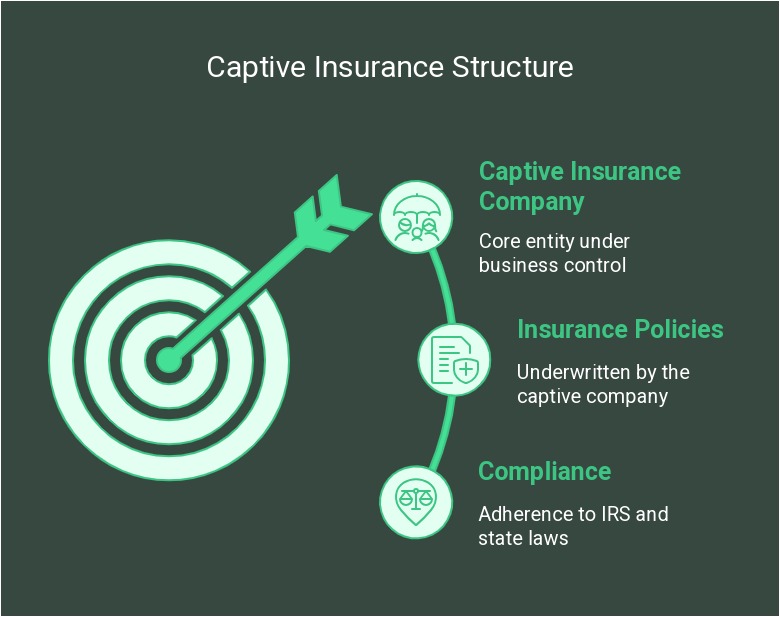

A captive insurance company is formed under your business’s ownership, licensed to underwrite insurance policies.

The captive is structured in compliance with IRS tax laws and state regulatory requirements.

Step 2: You Pay Premiums into the Captive, Reducing Taxable Income

Your business redirects funds into the captive instead of paying high commercial insurance premiums.

These funds are classified as deductible business expenses, reducing taxable income.

Step 3: Premiums Accumulate Tax-Free & Can Be Invested Strategically

Unlike traditional insurance, money inside the captive is retained and grows tax-free.

These funds can be strategically invested in real estate, equities, or alternative assets, further increasing financial returns.

Step 4: Claims Are Paid Out as Needed, Just Like a Traditional Insurance Company

The captive operates like a traditional insurer, covering specific business risks as needed.

Any unused funds accumulate within the captive, turning insurance premiums into long-term assets.

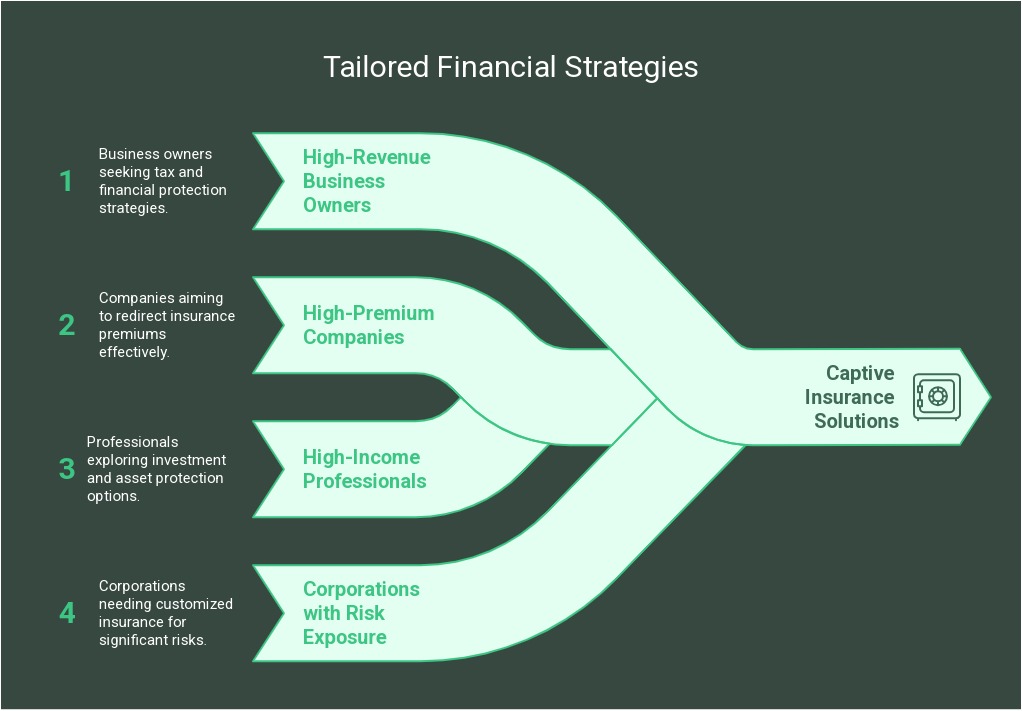

Who Qualifies for Captive Insurance & How to Get Started

Business owners generating $3M+ in annual revenue who want to reduce tax liabilities and increase financial protection.

Companies paying $250K+ annually in insurance premiums that could be redirected into their own captive.

High-income professionals and private investors seeking alternative investment vehicles and asset protection strategies.

Corporations with significant risk exposure that need customized insurance solutions instead of expensive commercial insurance policies.